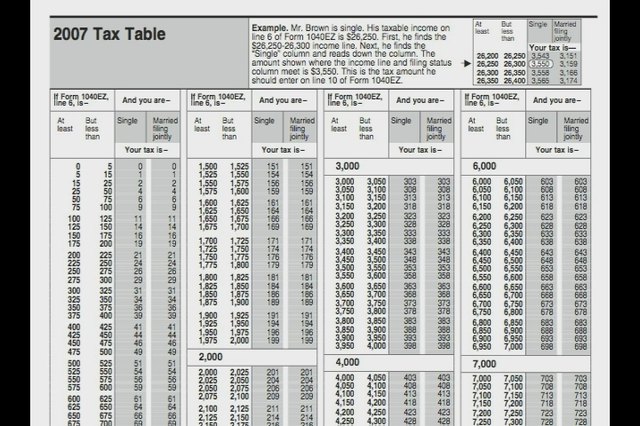

Ohio State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 5,200.00 Ohio State Single Filer Tax Rates, Thresholds and Settings Ohio State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction If you would like additional elements added to our tools, please contact us. The Ohio tax tables here contain the various elements that are used in the Ohio Tax Calculators, Ohio Salary Calculators and Ohio Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

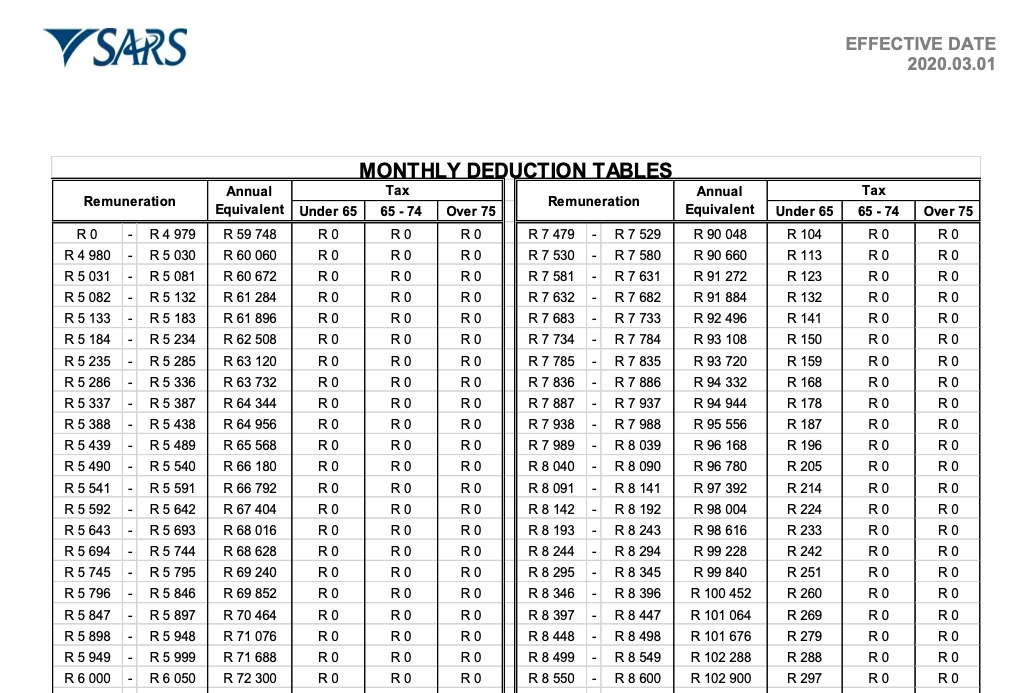

#2020 tax tables for seniors full

The Ohio State Tax Tables below are a snapshot of the tax rates and thresholds in Ohio, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Ohio Department of Revenue website.

This page contains references to specific Ohio tax tables, allowances and thresholds with links to supporting Ohio tax calculators and Ohio Salary calculator tools. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year.

The Ohio Department of Revenue is responsible for publishing the latest Ohio State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Ohio. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Ohio State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Ohio State Tax Calculator.

0 kommentar(er)

0 kommentar(er)